Child Tax Credit 2024 Changes – Here’s why you may want to wait to file your federal tax return if you’re claiming the child tax credit this year. . In 2021, the CTC was expanded after the passage of the American Rescue Plan. That year the tax was raised to $3,600 per child under the age of six, $3,000 per child between ages 6 to 17, and it was .

Child Tax Credit 2024 Changes

Source : www.npr.orgExpanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.orgIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comProposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.orgYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.orgEV tax credits 2024: VERIFY Fact Sheet | verifythis.com

Source : www.verifythis.comUS Child Tax Credit Changes 2024: What are the changes and What’s

Source : www.incometaxgujarat.orgChild Tax Credit Eligibility 2024: What changes were made for this

Source : www.marca.comChild tax credit could change — but don’t wait to file taxes, IRS says

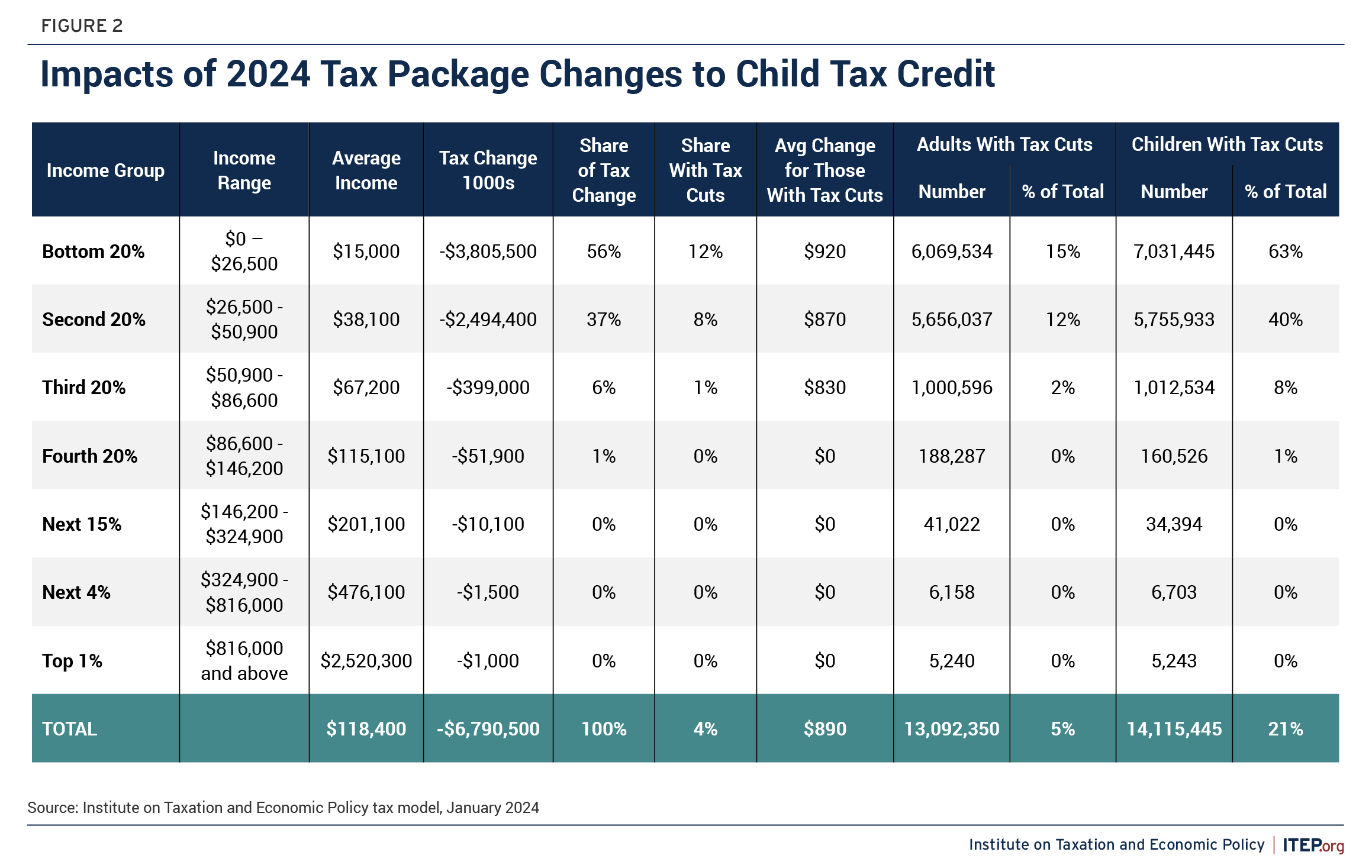

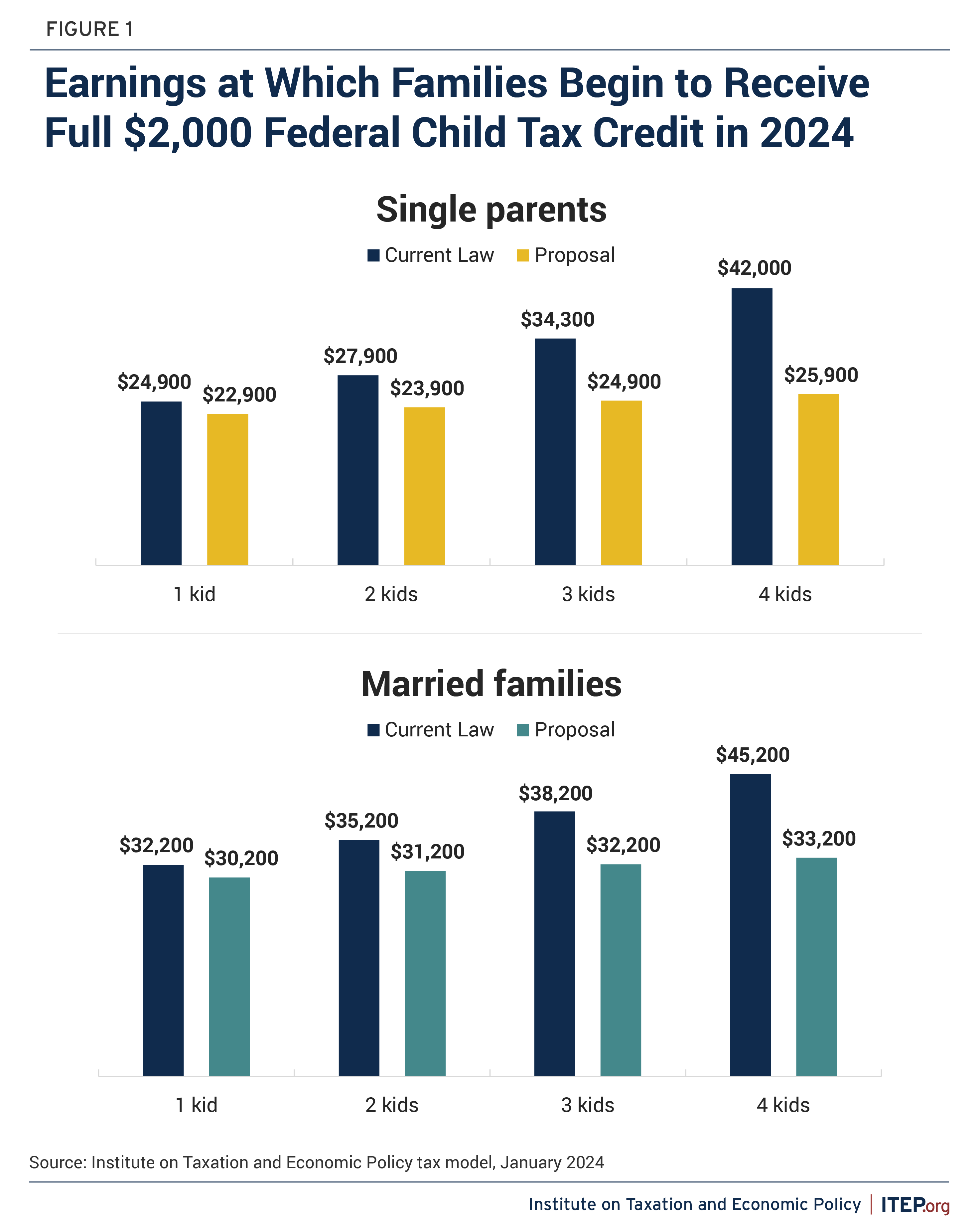

Source : www.cnbc.comChild Tax Credit 2024 Changes The $7,500 EV tax credit will see big changes in 2024. What to : The House of Representatives has approved an expansion of the Child Tax Credit which would increase the amount of the refund beneficiaries will receive. . In a significant move, the House of Representatives voted on Wednesday to approve an approximately $80 billion deal aimed at expanding the federal child tax credit. The deal focuse .

]]>